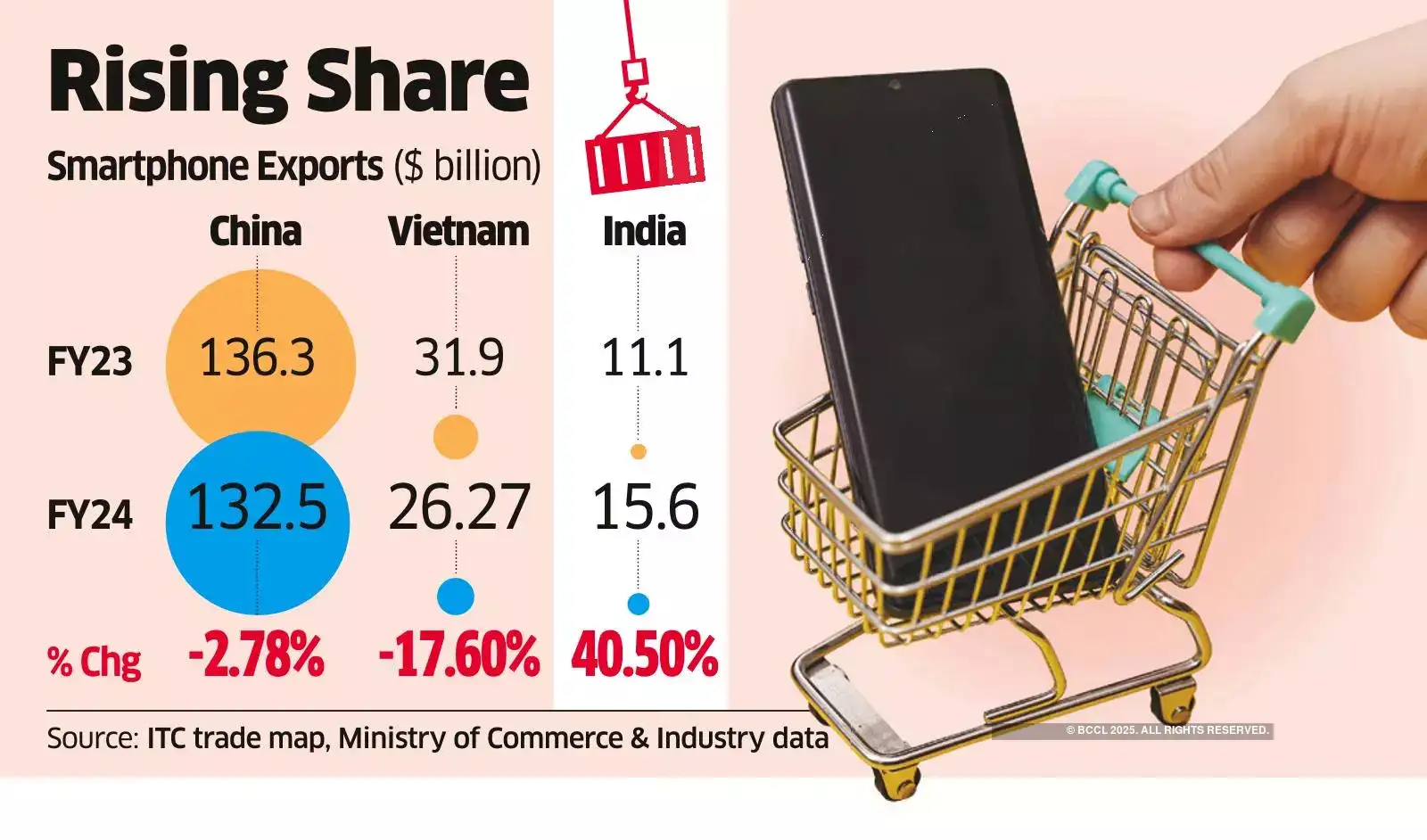

According to International Trade Centre (ITC) data, Chinese exports of mobile phones dropped from $136.3 billion in FY23 to $132.5 billion in FY24 – a 2.8% reduction, amounting to a $3.8 billion decline in total exports. Vietnam has also seen a fall in mobile exports from $31.9 billion in FY23 to $26.27 billion in FY24, a 17.6% reduction, or a $5.6 billion decline in total exports. Total cumulative reduction in exports from both countries amounted to $9.4 billion.

ITC is a joint agency of the United Nations and the WTO and has been operating since 1968. The ITC trade map covers 220 countries and territories and 5,300 products.

India’s exports of mobile phones has risen over 40% to reach $15.6 billion in FY24 from $11.1 billion in FY23, an increase of $4.5 billion.

“Data implies India captured nearly 50% of the total decline in mobile exports from China and Vietnam,” an official said. Experts said India grabbing its opportunity in mobile phone exports space is a big win for the government. In the wake of the geopolitical situation and tensions with China, government has been attempting to woo companies deploying China+1 strategy to diversify supply chains and manufacturing.The smartphone PLI scheme has been a success, particularly with Apple having made India its second base for iPhone manufacturing after China. The Cupertino-based giant started producing iPhones in the country under the PLI scheme announced in 2020. Three of its key iPhone vendors – Foxconn, Pegatron and Wistron (now owned by Tata) – set up factories in India following the scheme’s launch.Apple has doubled production and exports from India in last two fiscal years. According to info, submitted by Apple’s vendors to the ministry of electronics and IT (MeitY) under PLI plan, production rose from $7 billion in FY23 to $14 billion in FY24, and exports from $5 billion to over $10 billion in the same period. IPhone exports contribute 65% of India’s $15.6 billion mobile exports, and over one-third of India’s electronics exports, which crossed $29 billion in FY24.